South Korea has adopted the open market economy, and is thus negotiating with other countries to sign more FTAs, as well as allowing foreigners to invest in the country freely while encouraging domestic businesses to invest in foreign countries equally freely. The country offers advantages to foreign investors under the long-term objective of establishing itself as a major financial hub and logistics base of Northeast Asia.

Market Opening and FTAs

The country has opened its market in most sectors, including agriculture. Koreans have traditionally attached great importance to agriculture, viewing it as the basis of the universe. In 2015, the country also opened its rice market, the final area of the agricultural sector not subject to full international competition.

The country is pushing ahead with the complete opening of the market through FTAs. The country plans to sign FTAs with numerous countries with the aim of expanding its economic territory worldwide.

As of 2017, South Korea signed FTAs with 52 countries, including Chile, EFTA, ASEAN, India, the European Union, Peru, the United States, Turkey, Australia, Canada, China, New Zealand, Vietnam, and Colombia. In 2017, the country initialed an FTA with five Central American countries—Costa Rica, El Salvador, Nicaragua, Honduras, and Panama.

Busan Harbor, the largest port in South Korea

Support for Foreign Direct Investment (FDI)

South Korea encourages FDI under the Foreign Investment Promotion Act. In South Korea, FDI refers to a foreigner’s acquisition of 10% or more of the equity share of a domestic business through an investment of not less than KRW 100 million, or a foreign-based business’s borrowing of a long-term (5 years or longer) loan from its parent business in a foreign country and the like.

Under the Foreign Investment Promotion Act, the government guarantees the profits earned by foreign investors and offers them a variety of benefits such as tax incentives, cash support, and mitigation of land-related regulations. The country also protects foreigners’ intellectual property rights and foreign exchange transactions. Therefore, foreign investors are allowed to take the profits they earn in South Korea out of the country, on the basis of creative and efficient operation.

Specifically, foreign investors are eligible for support from the South Korean government concerning the land required for the establishment of factory or research facilities, the purchase or lease or construction of a building, or the installation of electric or communication facilities. They may ask for installment payments for up to 20 years in cases of purchasing land owned by either the central government or a local government.

In addition, the South Korean government also provides cash support taking into consideration FDI amounts and the number of locals to be employed. The government is ready and willing to provide land and capital if a foreign business displays excellent technological prowess and maintains the employment of a given number of locals.

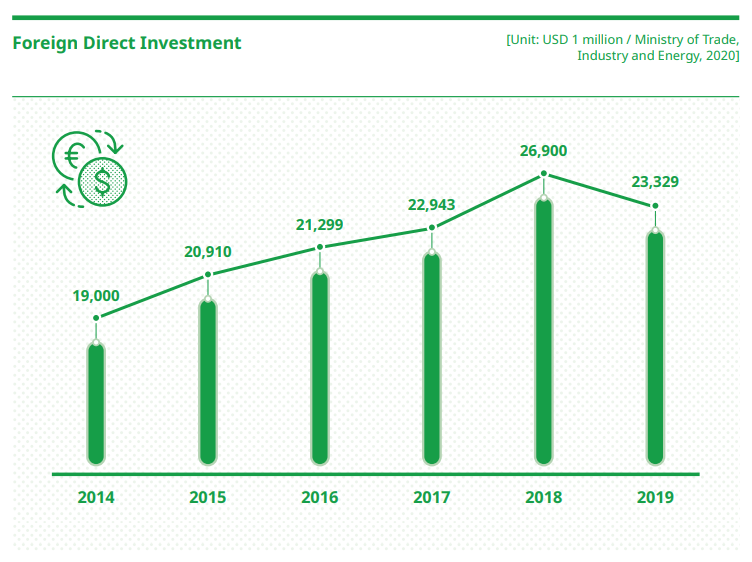

FDI in the country surged right after the foreign exchange crisis in 1998, with the increasing trend continuing. The reported amount of FDI as of 2019 stood at USD 23.3 billion; FDI had reached USD 20 billion for five consecutive years. The FDI amount suggests a balanced growth trend in terms of business types, had previously differed by investment type. The government plans to shift its policies in support of foreign investors and so called U-turn companies (Korean firms that refocus their investment on Korea as opposed to investing more abroad) to promote job creation.

The country also invites newly emerging countries with surplus funds, including China and the Middle Eastern countries, to invest in the service sector of the country with high added value. In order to create a favorable environment for FDI, the government hosts Foreign Investment Week (FIW) and provides a Red Carpet Service for foreign investors. The government also operates projects to promote FDI in local governments, including sending delegations to study investment feasibility and supporting investment projects.

The country also designates locals in the Unites States, the United Kingdom, China, and Japan as PR ambassadors for FDI in the country.

Investment to Become a Regional Logistics Hub

Incheon Airport as a Hub Airport

Incheon Airport is a regional hub airport, where all airplanes around the world can be operated for 24 hours without worrying about weather condition. In Northeast Asia, the main regional hub airports include Kansai Airport in Osaka, Chek Lap Kok Airport in Hong Kong, Pudong Airport in Shanghai, and Incheon Airport in South Korea.

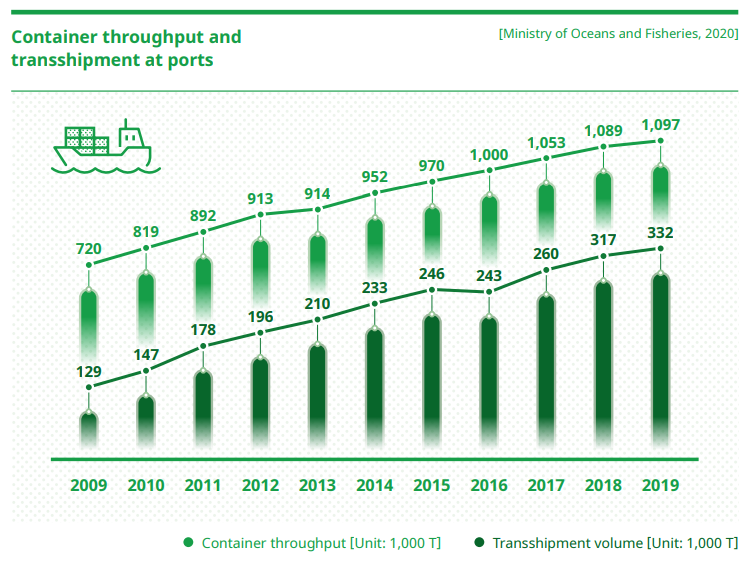

Container throughput and transshipment at ports (Ministry of Oceans and Fisheries, 2017)

South Korea is making preparations for a period when its combined export/ import volume is expected to reach USD 2 trillion. The country is also striving to become a major logistics hub of Northeast Asia.

The country is investing heavily in automation and the sophistication of export/import cargo stevedoring facilities, with the aim of greatly enhancing its logistics competitiveness.

The country is striving to invigorate its air cargo network and expand industrial complexes situated close to airports.

Incheon International Airport has marked an all-time record in cargo volume. Growth continued, reaching 2.76 million tons in 2019. According to Airports Council International (ACI), since 2013, Dubai International Airport (UAE) has ranked 2nd in terms of international freight volumes, beating Incheon International Airport. However, Incheon International Airport is striving to take its spot back by securing a future growth engine through the introduction of the incentive system to logistics in 2018.

Air cargo has high added value. It accounts for about one quarter of the total transportation charge, although it accounts for only 0.2-0.3% of all forms of transportation cargoes in terms of weight. The South Korean government has expanded the cargo terminal of Incheon Airport and trains talented young people to take charge of airfreight logistics at the relevant educational institutions.

In addition, the aviation logistics system is being drastically improved by utilizing advanced information and communication technologies. Incheon International Airport is equipped with high-tech air logistics information systems for cargo reservations and cargo tracking and continues to make up for the errors.

With the opening of Terminal 2 in January 2018, the annual cargo capacity of Incheon International Airport has increased from the previous 4.5 million tons to 5.8 million tons.

It is noteworthy that Incheon International Airport has ranked first in the world for 12 consecutive years in the annual evaluation of airport services conducted by the ACI, a consultative council for more than 1,700 airports around the world. This testifies to the sheer quality of operation of Incheon International Airport. Furthermore, the airport became the first airport in the world to be registered with the Airports Council International Hall of Fame.

Located on the peninsula, South Korea has many international trade ports including Busan, Incheon, Pyeongtaek, Gwangyang, Ulsan, Pohang, and Donghae. In 2019, the volume of cargo handled at the country’s ports stood at 1,643.97 million tons (RT), increasing by 1.2% year on year.